Singapore’s real estate market is among the world’s most expensive. In fact, house costs in the city-state are Asia’s second highest.

You’d have to pay in the range of $2 million just to buy a tiny, two-bedroom apartment in desirable location like Orchard or Central.

Because of these high costs, most locals don’t even own private real estate in Singapore. More than 80% of Singaporeans live in public flats built by the Housing and Development Board (HBD).

To be clear, public housing in Singapore is far better than anywhere else. We’re talking about a wealthy country where one out of every five families are millionaire households.

Such a vast majority of people living in HBD flats is testament to the nation’s wealth inequality though. Private property ownership in Singapore is almost purely for the rich. Everyone else is stuck with rentals and government subsidized apartments.

Despite its economic issues, we’re positive about the long-term prospects of Singapore’s real estate market as a whole.

As investors, we don’t simply look at the price tag in absolute terms – we’re interested in overall value.

Singapore suffered more than two straight years of falling home values before finally reaching a point of reasonability. Yet there’s now a good argument that Southeast Asia’s financial center has plenty of value compared to its peers.

Just because a property market is expensive doesn’t neccessarily mean it’s overpriced.

Real Estate in Singapore is Undervalued

Yes, you read that correctly. We think Singapore is undervalued even though it’s among the most expensive property markets on the planet.

This may sound confusing, but we have a reason.

Analysts often compare real estate prices in Singapore to its less developed peers like Kuala Lumpur and Bangkok, but that’s a mistake. A fairer comparison for Singapore would be with another small, competing financial center like Switzerland.

Singapore is Southeast Asia’s unofficial financial hub, but there’s a limited amount of space on the island. Population density exceeds 8,000 people per square kilometer on average.

This makes Singapore the world’s third densest country. It’s cramped even compared to Hong Kong’s 6,700 people per square kilometer – and especially Switzerland’s 200.

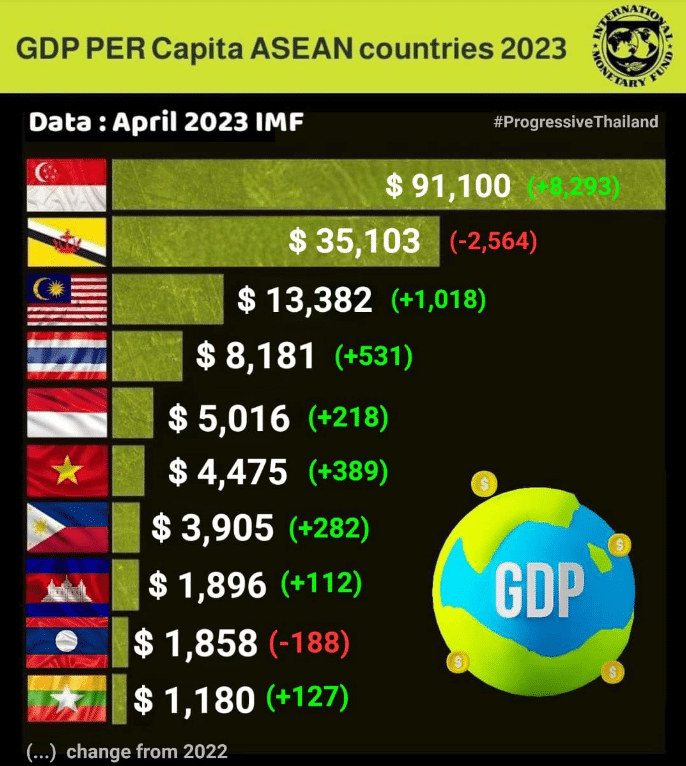

Furthermore, Singapore is the third richest nation in the whole world. Their GDP per capita is more than $90,000.

A wealthier country with less available land should normally have higher property values than their peers. Nonetheless, Singapore real estate is costs under half the price of Hong Kong’s and noticeably lower than in Zurich.

Considering the city’s recent economic growth is also higher than its competitors, you might now understand why Singapore’s property market is potentially undervalued.

Buying property in Singapore isn’t such a bad deal when comparing its consumer purchasing power, GDP per capita, and general economic health with other Asian markets.

UHNWIs in Singapore

Real estate is ultimately worth what someone is willing to pay for it. Yet here’s the good news for Singapore:

Foreign property investors, many of them Chinese UHNWIs, should sustain the property market over the long-term.

Governments have a history of making it hard for their tax base to leave once times get rough. This happened everywhere from the United States Gold Confiscation in 1933, to Nazi Germany, to the Chinese Cultural Revolution.

Singapore has a solid banking system, strong rule of law, competent governance and business-friendly policies. Bank deposits and property in Singapore are therefore among Asia’s top safe-haven assets.

Singapore Property Market vs. Hong Kong

Meanwhile, China now placed limits on foreign transfers in order to keep capital inside the country. Relatively new laws make it increasingly difficult for wealthy mainlanders to invest abroad.

Crypto, overseas credit card transactions, gambling, and collectibles are merely a few ways that UHNWIs have secretly moved their wealth across borders.

Up until fairly recently, Hong Kong was almost universally preferred as an option for rich Chinese loved parking their wealth. It was convenient, a closer flight, and enjoyed close links with the mainland while being governed separately.

Developments over the past decade have made some UHNWIs in China reconsider if holding their assets in Hong Kong even counts as global diversification anymore.

Granted, that’s only positive for Singapore’s real estate market and overall economy.

Despite the high costs, we’re bullish on Singapore. Real estate prices are high for a reason and expense by itself doesn’t mean you’re getting a bad deal.

Indeed, plenty of observers have thought that Singapore’s housing market has been “too expensive” for well over a decade. That hasn’t stopped prices from rising even further in the meantime.

Yet at the same time, we still think places like the Philippines, Malaysia, and Cambodia have superior long-term prospects in comparison.

Singapore’s high entry point and tepid growth are reasons why you may consider instead buying property in Asia’s nearby emerging and frontier markets.

Real Estate in Singapore: FAQs

How Much Does Housing in Singapore Cost?

If you're looking at prime real estate in Singapore, you should expect to pay about $20,000 per square meter for a luxury condo unit in a central location.

Looking further into Singapore's suburbs, such as Woodlands and Ang Moh Kio, you'll find plenty of residential homes for closer to $10,000 per sqm though.

Can Foreigners Buy Property in Singapore?

Yes, foreigners can own freehold condos in Singapore without any restrictions.

However, while there isn't a limit on property ownership itself, you'll have to pay a whopping 60% transfer tax as a non-resident foriegner!

It's technically possible to buy residential land and houses in Singapore too. This requires special approval from the government though.

Is Land in Singapore Freehold or Leasehold?

Singapore has both freehold and leasehold property of all types, whether you're looking at condo units or bungalows.

Term lengths for leasehold property in Singapore range from 99 to 999 years. You'll find plenty of freehold options as well though. The ownership rights will depend on the specific piece of land.